Summary

Staying compliant with health plan regulations is critical for employers. Learn about key year-end deadlines and reporting requirements for your group health plan under ERISA, ACA, and CAA to avoid costly penalties and ensure employer health plan compliance.

As the end of the calendar year approaches, employers that sponsor group health plans must ensure timely compliance with several federal reporting and disclosure requirements. These obligations, mandated under various federal laws, including the Employee Retirement Income Security Act (ERISA), the Affordable Care Act (ACA) and the Consolidated Appropriations Act (CAA), must be fulfilled in a timely manner to avoid potential penalties.

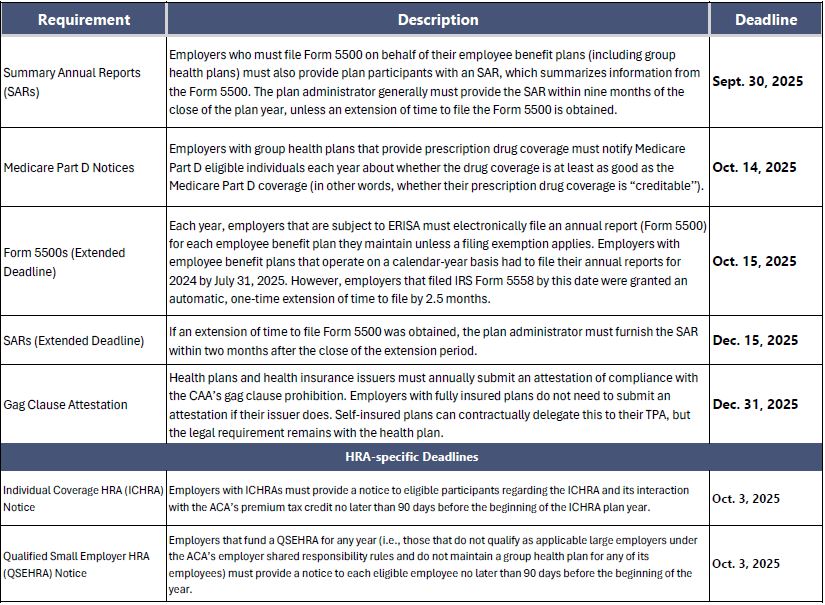

The table below focuses on key dates relevant to plans that operate on a calendar year basis to assist plan sponsors in meeting their year-end obligations.

In addition to the deadlines above, the end of the plan year is a good time to ensure that all applicable annual notice requirements (e.g., the Children’s Health Insurance Program notice) have been satisfied.

©2025 Zywave, Inc. All rights reserved.

At GTM Insurance, we understand the importance of compliance. We can help you with your open enrollment strategy, from benefits plan design to communication and administration, so you can focus on your business while we handle the complexities. Contact us at (518) 373-4111 or schedule time with an insurance team member today.