Blog

Understanding insurance and employee benefits

GTM Insurance Adds Industry Veteran to Lead Employee Benefits Practice

The GTM Insurance Agency, a trusted, locally owned and operated firm with national reach, has added Keith Dolan as Senior Benefits Manager. With over 30 years of experience in the benefits industry at agencies and large health insurance carriers, Dolan will lead the...

Insurance Coverage Vs. Value: Know the Difference

Understand the crucial difference between home insurance coverage & replacement cost. Avoid being underinsured! Learn how to determine accurate coverage and protect your finances.

Protecting Your Business from Liability: 6 Key Insurance Policies to Consider

Every business is unique. Discover essential insurance options tailored to your size, industry, and location. Protect against risks with general liability, cyber insurance, and more.

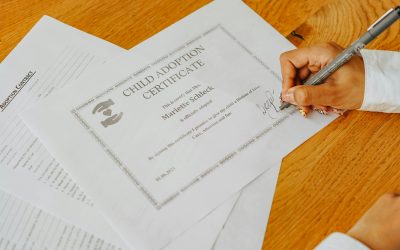

Should You Add Adoption Benefits to Your Employee Benefits?

Discover the growing trend of employer adoption benefits. Learn about financial assistance, parental leave, legal details, and tax advantages. Equip your company to support adoptive families.

What is Renters Insurance?

Understand renters insurance: protect belongings, liability, & living expenses. Learn about coverage, costs, and Personal Article Floaters (PAFs) for valuables.

Voluntary Benefits: A 2025 Guide

Discover the top voluntary benefit trends for 2025. From student loan repayment assistance to cybersecurity protection, learn how these benefits are shaping employee attraction and retention.

What is an Employee Assistance Program (EAP)?

Implementing an Employee Assistance Program demonstrates your company’s value for your team. Providing access to helpful resources, counselors, and coaches can help employee retention and reduce workplace stress.

What is a QSEHRA?

A Qualified Small Employer Health Reimbursement Arrangement (QSEHRA) is a valuable tool for small businesses that don’t offer traditional group health insurance to their employees.

Building a Resilient Business: 4 Reasons Why a Risk Assessment is Essential

Learn why a risk assessment is crucial for minimizing disruptions, reducing financial losses, and ensuring employee safety. Discover how to conduct a thorough risk assessment and build a resilient business.